Accounts Payable Outsourcing Services

Get the smarter tools you need, and the assistance to keep you confident

Accounts Payable Outsourcing Services

Services We Offer

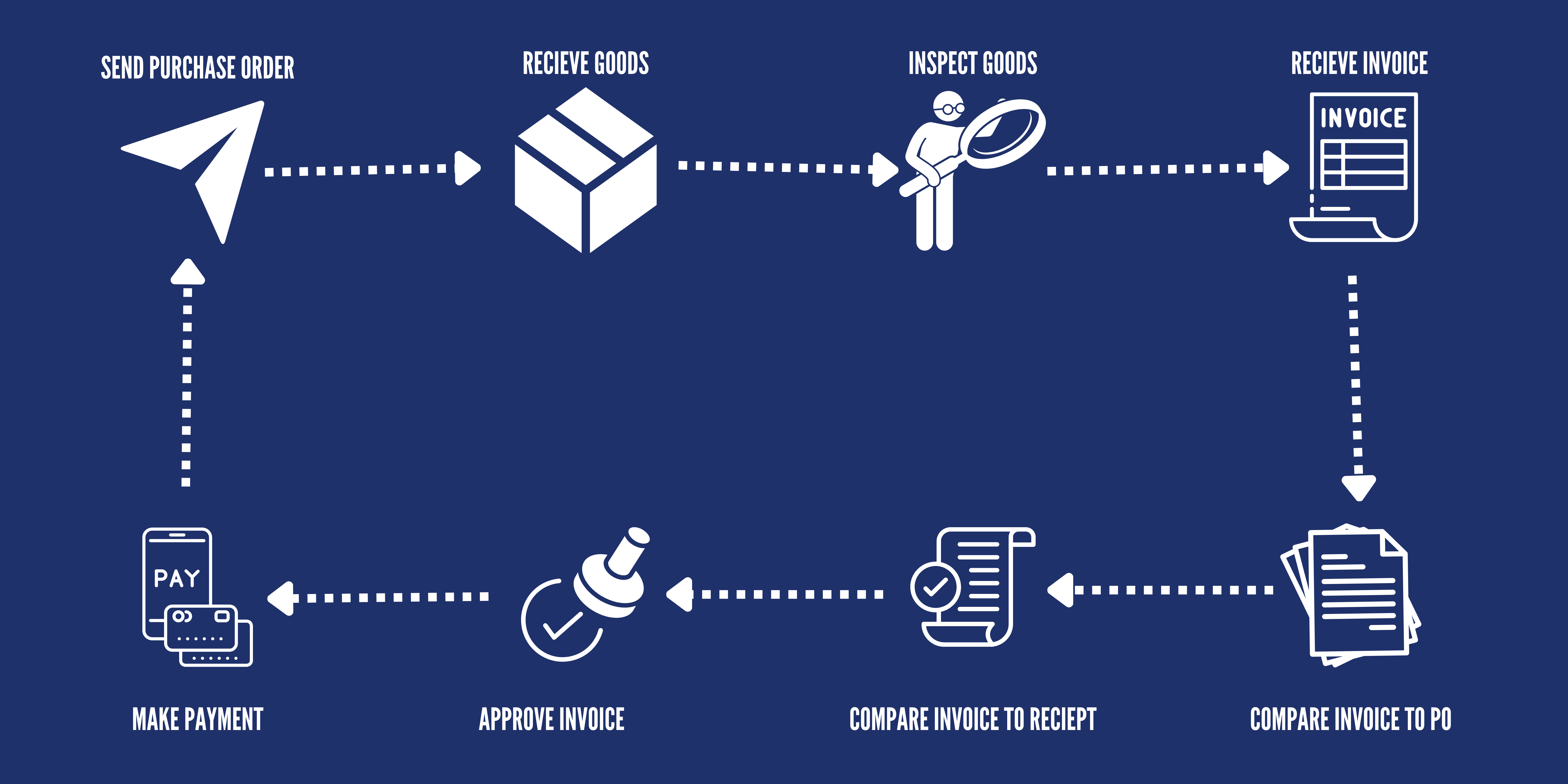

Accounts Payable Process

Benefits of Accounts Receivable Outsourcing

- Cost Savings:

- Outsourcing accounts payable reduces overhead costs associated with hiring and training in-house staff. It also eliminates the need for investing in expensive accounting software and infrastructure.

- Improved Efficiency:

- Specialized accounts payable service providers have streamlined processes and advanced technologies that enhance the efficiency and accuracy of your accounts payable operations.

- Access to Expertise:

- Outsourcing gives you access to a team of professionals with extensive knowledge and experience in managing accounts payable, ensuring compliance and best practices.

- Scalability:

- As your business grows, your accounts payable needs will evolve. Outsourcing allows for easy scaling of services to match your business requirements without the hassle of managing additional resources in-house.

- Focus on Core Business Activities:

- By outsourcing routine accounts payable tasks, your in-house team can focus on more strategic and value-added activities that drive business growth.

- Reduced Errors and Risks:

- Outsourcing minimizes the risk of errors in invoicing, payments, and data entry. Service providers use advanced technology and quality control measures to ensure accuracy and compliance.

- Enhanced Cash Flow Management:

- Professional accounts payable services can help optimize your cash flow by managing payment schedules and taking advantage of early payment discounts and favorable terms.

- Advanced Technology and Automation:

- Outsourcing providers leverage the latest technology and automation tools, offering real-time visibility into accounts payable processes and enabling faster, more accurate decision-making.

- Improved Vendor Relationships:

- Timely and accurate payments, facilitated by outsourcing, can improve your relationships with suppliers, leading to better terms and potential cost savings.

- Regulatory Compliance:

- Accounts payable service providers stay updated with the latest regulations and standards, ensuring that your business remains compliant with financial and tax laws.

As the business marketplace gets more competitive by the day, your enterprise has to hunt ways to enhance services and emerge from the competition. Accounts payable outsourcing can be a feasible solution for businesses looking to stay emerge in the most competitive world and reduce costs in the process.

Many enterprises and businesses are turning to accounts payable outsourcing to specialized third-party teams. Accounts payable outsourcing services will assist them to:

- Locate areas where they can reduce costs to improve their profit margins

- Improve their organization performance

Better manage their cash flow and working capital

Accounts Payable Outsourcing Services

Accounts payable outsourcing refers to appointing a third-party team to handle your accounts payable process for you. Your accounting department will have many jobs to fulfill since liabilities such as short-term debts and handling your creditors are given to qualified third parties.

Accounts Payable Outsourcing Services include:

- Accounts receivable management

- Discrepancy resolution

- Accounts payable administration

- Sending purchase orders

We are here to handle your accounts payable process when you outsource accounts payable services to us. Your in-house Account payable departments can then concentrate on foremost tasks and attend to the key business processes to improve the performance of your company and enhance service levels.

Why Should You Outsource Your Accounts Payable?

If your business still uses out of date systems, for example paper invoicing and optical character recognition (OCR) to handle your Accounts payable process, then you have a huge challenge on your hands. Upgrading these outdated accounting systems to modern tools, such as QuickBooks, can be an expensive and time-consuming process. Thanks to the chance of finance and accounting outsourcing services, you may not have to worry about the budget of improving such systems.

Accounts payable service provider can assist you acquire an edge over your competitors in the industry without a system to modernize, because that would be very costly and may affect your business tasks for some time. Your business can also acquire benefits from outsourcing accounts payable to us, so we can improve overall efficiency of your company.

What Is Accounts Payable Outsourcing

Accounts payable outsourcing is the practice of hiring a third party to manage your firm’s accounts payable processes. Accounts payable service providers come fully armed with the skills, tools and upgraded technology not only to handle your existing accounts payable processes but also to integrate the latest capabilities to offer you a more streamlined environment. The best accounts payable service providers don’t just take over your AP duties. They enhance and augment them.

Accounts payable services aren’t for everyone. Some enterprise manages sensitive financial data, which makes it hard or impossible for them to hand it over to accounts payable service providers. Other enterprise prefers to take up upgraded technology and processes in-house rather than hand control of their operations to another enterprise.

What Are Bookkeeping Services for a Business?

When a mid-sized or small businesses buying from a supplier, they normally do so on a credited relationship that they have with their sellers. Accounts payable is a short-period liability account which narrates the total amount of supplier credit that your organization owes a seller at any particular time.

In simple words, accounts payable are liabilities that have to be paid up within a specific time period. They’re usually short-term debts to acquire items such as short-period loans, taxes, and even supplies for your workplace.

During your bookkeeping transactions, you use accounts payable when buying products. For example, if you buy $250 of shipping supplies and use store credit to totally pay for the supplies, then you’ll have to make an extra entry in the cash disbursements account you have, the expenses account/journal, and in the cash journal.

Why You Should Consider Accounts Payable Outsourcing

The advantages that come with accounts payable services are nearly countless. Appointing a third-party company to outsource your duties doesn’t mean that you’re just giving basic tasks, such as data entry, to another organization to manage.

Accounts payable outsourcing will offer your business with an impressive increase in accounts payable efficiency, assisting to add more value to your company.

Offer you with more resources

We are here to offer accounts payable services because we have the latest technology and tools that your company need to assure that your process is as optimized as it can possibly be. Some of the tools that will be used by us include reporting tools and automation.

So, rather than your company having to go through and find all the tools and technology that you need for accounts payable, you can appoint us and hire these tasks/duties to us. By doing this, you’ll have access to all the advantages of updated technology at a reasonable cost.

If you’re looking to improve the performance of your company, optimizes results, and lesser the risks of errors, then consider us for accounts payable outsourcing. With us, you’ll be able to acquire all of the advantages that account payable outsourcing has to offer.

The Benefits of Outsourcing Accounts Payables

Here we have enlisted some key benefits of outsourcing accounts payable:

- Cost Benefits: The most obvious benefit is cost savings that accounts payable outsourcing brings about. You can get your job done at a reasonable cost and at better quality as well.

- Boost Efficiency: Accounts payable outsourcing brings in years of experience in business practices and expertise in delivering outsourcing projects.

- Fast and Better Services: It takes your service offering better with high quality deliverables and reduce the lead time it takes to reach the marketplace.

Frequently Asked Questions

As far as Volume is concern there is no Limitation as such. Ad depend on the Invoice Volume we will put our resources. We can handle anything from 50 (or less) Invoice onwards.

As Invoice processing is not the core finance function for businesses and it eats a lot of time and hence Keeping these functions at check is really needed. Large amount of Invoices means huge investment of time by any accountant at your place.

We mostly do Manual AP Processing work whereas Automation can be available with the help of our Strategic Partner and generally have capping on certain number of Invoices.

We are quite flexible on this and go with our customer choices on their preferred method of Document sharing. But to highlight few we use One Drive, Google Drive, Dropbox etc.

In the initial phase of our Discussion we would like to understand the number of approver involve in the process and set up the same in the system (if the process is in place)

As a first step in Such cases where we see some issues in the invoices like Amount not matching, Double Invoice, name correction etc we first email to Representative assigned by Client at their end and inform the same to get more clarity and proceed according to their method.

It depend on how many lines of Item an Invoice has. If it is a single line Invoice it would hardly take 30 to 60 second to process.